Why visit ACE ’25?

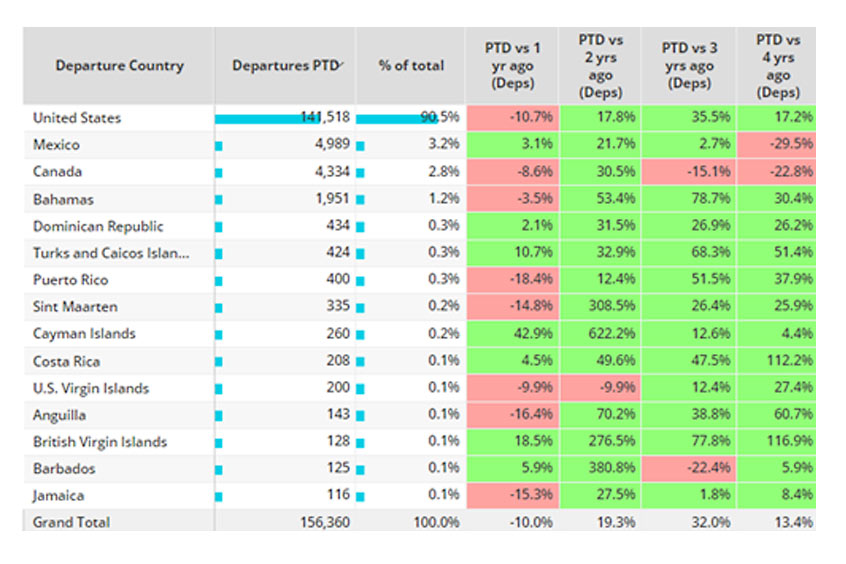

There were 54,888 business jet departures from North American airports in week 11, three per cent less than for week 10 and 10 per cent fewer than the same dates last year. Over the last four weeks, activity is nine per cent behind last year. Part 135 and Part 91K activity during week 11 was on par with the previous week at 16 per cent below that of the same dates in 2022. So far this month, 88 per cent of business jet activity comprises domestic flights; these are down 11 per cent compared to the same 20 days in March 2022 but 14 per cent ahead of 2019. International sectors are down four per cent compared to last year and 10 per cent ahead of 2019.

Teterboro is the busiest departure airport for Part 135/91K business jets this month, although activity is down 16 per cent compared to last year. Super midsize jets are the busiest in the Part 135/91K fleet departing from airports in the United States, with sectors down six per cent compared to last year. The Embraer Phenom 300 is the busiest aircraft type this month, and the Cessna Citation Latitude is the only top aircraft with activity ahead of last year.

According to WingX's weekly Global Market Tracker, worldwide business jet sectors in week 11 of 2023, 13-19 March, amounted to 70,444 sectors. This represents a one per cent decrease compared to week 10 and a seven per cent decrease compared with the same dates in 2022, while the global trend for the last four weeks is eight per cent behind. Global Part 135 and Part 91K business jet activity in week 11 was 14 per cent below the same dates last year. For the year-to-date, business jet and turboprop activity is two per cent behind last year but 12 per cent ahead of 2019.

In Europe, 10,045 business jet sectors were flown in week 11, which is eight per cent more than in week 10 but one per cent down on the same dates in 2022. In the last four weeks, flight activity has fallen 11 per cent below the same dates in 2022. For the full month, sectors are down seven per cent compared to last year but five per cent above 2019. Excluding Russia, business jet flights this month are six per cent behind last year and eight per cent ahead of 2019. 71 per cent of business jet activity this month is on international flights; these flights are seven per cent below last year but seven per cent above 2019. Domestic business jet sectors are seven per cent down on last year, on a par with 2019.

The top European markets this month are seeing declines compared to last year. France, the busiest market this month, is seven per cent behind last year in terms of flight departures, as is the UK. Germany has seen sectors fall four per cent behind last year and two per cent behind 2019. Departures from Russia are down 35 per cent compared to March last year and 59 per cent down compared to 2019. Le Bourget is the busiest departure airport this month, with flights down three per cent compared to last year. Elsewhere Geneva is down 11 per cent compared to last year, Farnborough down eight per cent, Zurich up one per cent and Amsterdam Schiphol up 18 per cent.

Week 11 2023 business jet activity in Africa was up 15 per cent compared with the same dates last year, while Asia was up 28 per cent, Middle East up 17 per cent and South America up 11 per cent. So far this month, total ROW business jet activity is 17 per cent ahead of last year and 78 per cent ahead of 2019. Brazil, Australia and India were the busiest three countries, all seeing demand well above last year. Tracked business jet activity in China is 48 per cent higher this month than in March last year, but still eight per cent below comparable activity in 2019.

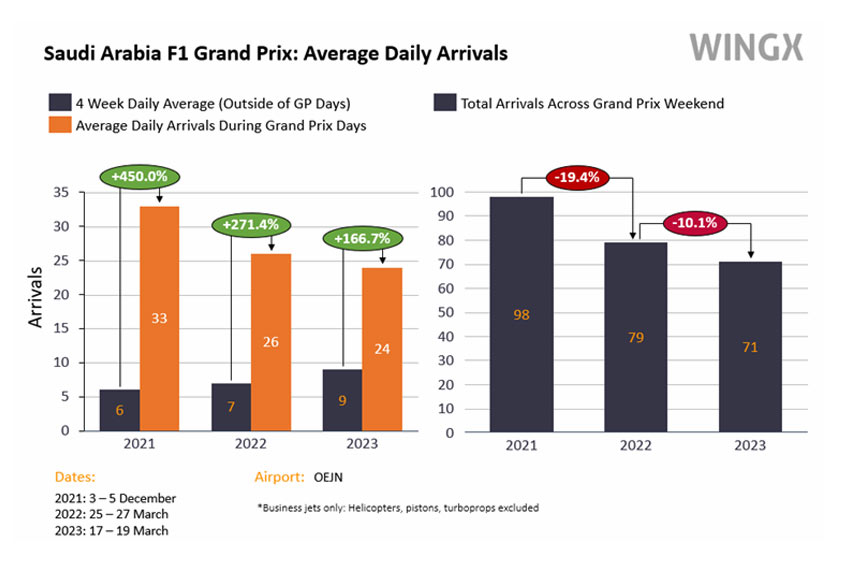

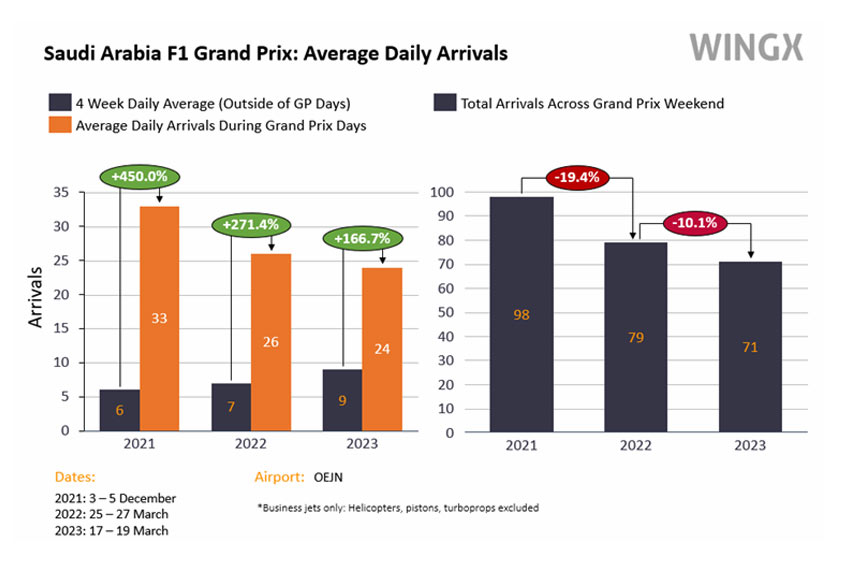

Business jet activity in Saudi Arabia this month was 45 per cent ahead of last March and 92 per cent ahead of 2019. Average daily business jet arrivals into King Abdulaziz International airport in Jeddah during the F1 Grand Prix on the weekend of 17-19 March saw triple digit growth compared to the four-week average, although the total traffic was down on the last two years’ events.

WingX managing director Richard Koe says: “Since week four of this year we have seen widening declines in business jet flight activity compared to the same weeks last year, with weekly double digit declines in charter activity since week seven. Week 11 saw a 16 per cent year on year dip in the US, a 22 per cent decline in Florida and 10 per cent drop in charters in Europe. The recovery in longer international sectors is also running out of steam, with transatlantic traffic falling one per cent behind record levels in February 2023.”