Why visit ACE ’25?

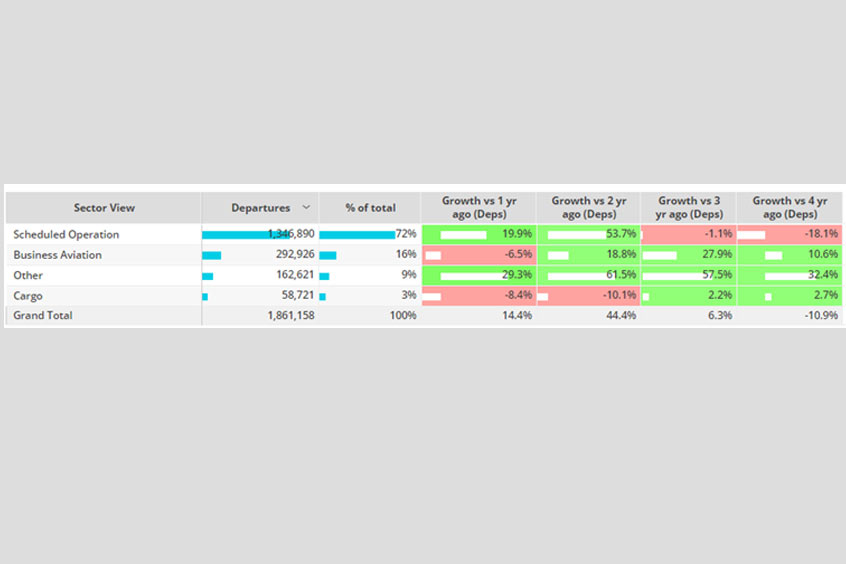

Worldwide business jet sectors in week 10 of 2023, 6-12 March, amounted to 70,829 sectors, representing a four per cent increase compared to week nine of 2023 and a seven per cent decrease compared to the same dates in 2022.

The global business jet trend for the last four weeks is seven per cent behind the same dates last year. Global Part 135 and Part 91K business jet activity in week 10 was 15 per cent below the same dates last year. Year to date (1 January-13 March), business jet activity is three per cent behind last year, but still 16 per cent ahead of 2019. Focussing on business jet activity for 1-13 March, flight sectors are nine per cent down compared to last year, but still 17 per cent ahead of March 2019.

According to WingX's weekly Global Market Tracker, week 10, 56,316 business jet sectors departed North American airports, six per cent more than week nine, but eight per cent less than the same dates last year. In the last four weeks activity is eight per cent below the same dates last year. Part 135 and Part 91K activity during week 10 was five per cent up compared to week nine, but 15 per cent below the same dates in 2022.

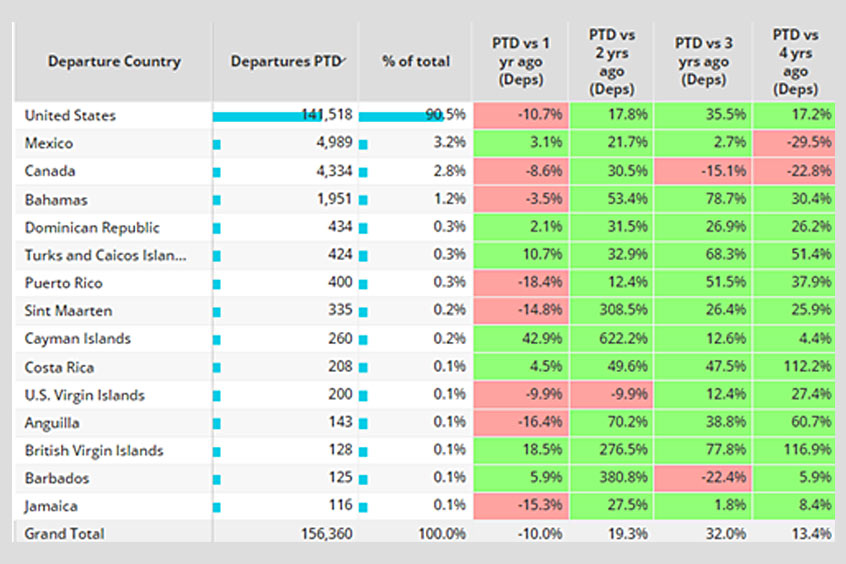

Business jet departures from North America are down 10 per cent so far this March compared to a comparable 2022, but remain 15 per cent above comparable 2019. Private flight departments and fractional operators are flying two per cent and three per cent more respectively this month compared to last year, which is 26 per cent and 38 per cent respectively ahead of 2019. Despite flying nine per cent more sectors than 2019, branded charter flights are 28 per cent behind a comparable last year. Corporate flight department flights have fallen two per cent behind March 2019 and 15 per cent behind March last year.

Focussing on US business jet activity in March, sectors are 11 per cent behind a comparable last year, but still 19 per cent ahead of 2019. 93 per cent of flights have been domestic this month and just seven per cent international. Domestic flights are down 12 per cent compared to last year, but are still 19 per cent ahead of 2019. International flights are on par with last year and 21 per cent ahead of 2019. Mexico is the top international destination this month, with flights down eight per cent compared to last March, although 28 per cent ahead of 2019. Flights to Canada are still behind pre-pandemic 2019 by 14 per cent, but rebounding three per cent ahead of last year.

Transatlantic business jet sectors (North America-Europe) are up three per cent so far this month compared to a comparable 2022 and remain 31 per cent ahead of 2019. US-UK is the busiest country flow, with flights down eight per cent compared to last year but up 49 per cent compared to 2019. Other top connections are between the United States and France, Ireland and Spain. Flights between the US and Switzerland and Italy are below last year at minus three per cent and minus nine per cent respectively.

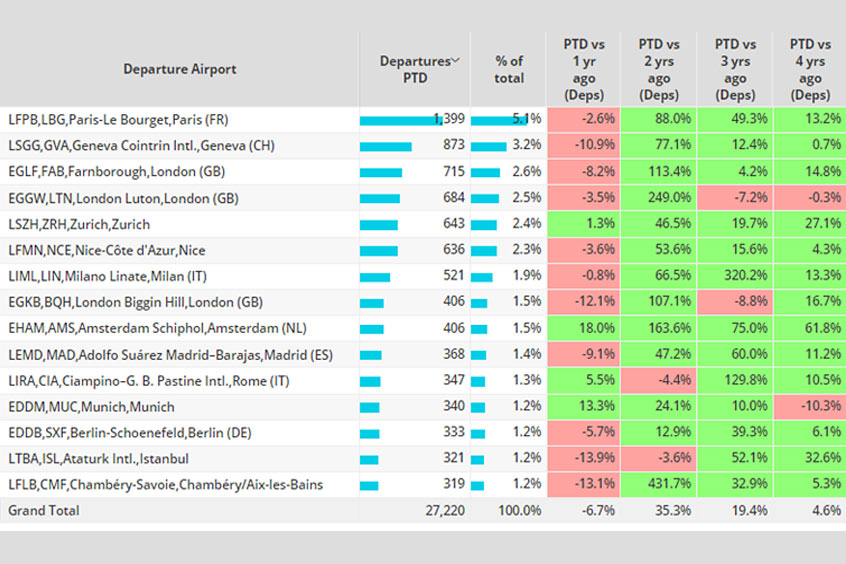

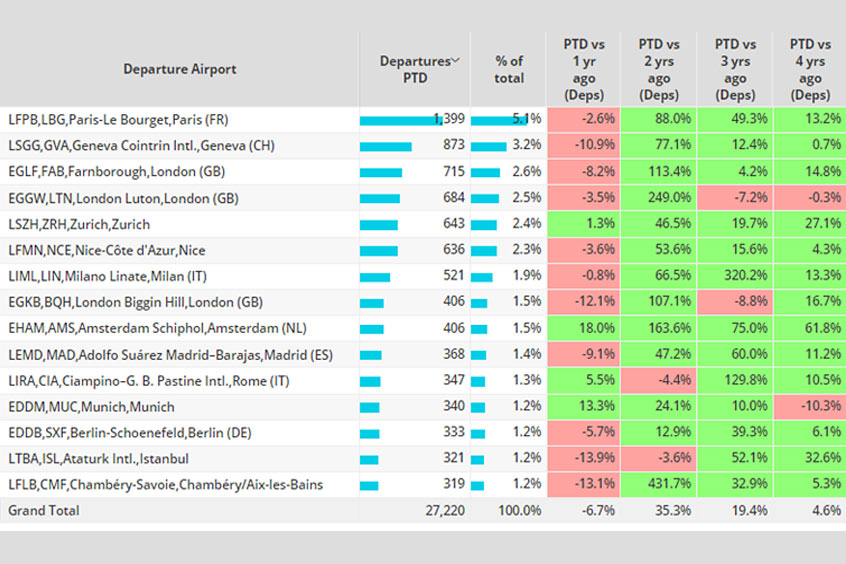

In Europe, 9,292 business jet sectors were flown in week 10, which is two per cent more than in week nine, but seven per cent less than the same dates in 2022. In the last four weeks activity is 11 per cent below the same dates in 2022. Business jet sectors in March are down nine per cent compared to last year, although four per cent above 2019. Excluding Russia the trend this month is eight per cent behind last year, but eight per cent ahead of 2019. 71 per cent of business jet activity this month is on international flights; these flights are nine per cent below last year yet five per cent above 2019. Domestic business jet sectors are seven per cent down on last year, but three per cent ahead of 2019.

Branded charter and aircraft management fleets are seeing double digit declines in flight activity compared to last March, 15 per cent and 11 per cent down on 2022 respectively, with aircraft management fleets seeing a 12 per cent fall compared to February 2019. France is the busiest market so far this month, followed by the UK and Germany. In Maastricht, the hosting of the TEFAF annual art, antiques and design fair had a significant impact on business jet arrivals into Maastricht Aachen airport; during the first two days of the event, which were invite only, business jet arrivals saw triple digit growth compared to the average daily arrivals in the last four weeks.

For the rest of the world, in week 10 of 2023, 6-12 March, activity in Africa was up one per cent compared with the same dates last year, Asia up 18 per cent, Middle East up three per cent and South America up 16 per cent. So far this month ROW business jet activity is 17 per cent ahead of last year and 78 per cent ahead of 2019. Brazil, Australia and India are the top three markets, all seeing demand above last year. China has seen activity drop two per cent below a comparable 2019, 36 per cent ahead of this year.

Richard Koe comments: “March 2022 was the record peak in business aviation activity, reflecting pent up demand as the pandemic faded and lockdowns were released, so it's not a great surprise to see lower YOY activity. However, with emerging concerns of another global financial crisis, we may well see further softening in business jet usage in the next few months.”