Why visit ACE ’25?

Just 16 days into January 2023 the business jet and turboprop sectors are three per cent ahead of the same 16 day period in 2022 and 16 per cent up on 2019.

With a focus on just business jets, WingX's weekly Global Market Tracker show that sectors are one per cent ahead of last year and 20 per cent ahead of 2019. Between 16 January 2022-2023 there were 3.7 million sectors flown, 11 per cent more than the previous 12 month period, whereas there were 1.8 million turboprop sectors, up seven per cent.

115,000 business jet sectors departed from locations in North America in the opening 16 days of January, on a par with the same 16 day period last year and 19 per cent more than in January 2019. Flight hours for the same period are down one per cent compared to last year, but 31 per cent above 2019. So far this month fractional operators are seeing 41 per cent growth in sectors flown compared to pre-pandemic January 2019. Private flight departments are flying 23 per cent more sectors than in January 2019, demonstrating the effect of new aircraft owners. Despite an 18 per cent drop compared to January last year, branded charter sectors are trending 20 per cent higher than in January 2019.

Over half of all business jet flights in North America this month have been less than 1.5 hours in length, with flights of this duration up four per cent compared to last year and 12 per cent higher than 2019. Flights between six to 12 hours have seen a large rebound compared to last year, with departures up 18 per cent. Despite 19 per cent growth compared to 2019, ultra long-haul flights of 12 hours or more are down 17 per cent compared to last year. There were 17,000 North America to Europe business jet market flights between 16 January 2022-2023, 54 per cent more than the previous 12 months. Between 1-16 January this year there were 700 flights, 29 per cent more than last year and 35 per cent more than 2019.

The Bombardier Challenger 300/350 is the busiest business jet so far this month, while light jets make up the busiest aircraft segment. The Challenger 300/350 flew seven per cent more sectors in the opening 16 days of this month compared to 2022, and 20 per cent more than in 2019. Flight hours over the same period were four per cent higher than last year and 21 per cent more than 2019. Florida is the busiest state for Challenger 300 departures, but with departures down seven per cent compared to last year. Compared to January last year California and Texas are seeing double digit growth in Challenger 300/350 departures, whereas Colorado is down four per cent compared to last year. Van Nuys/McCarran is the busiest branded charter business jet airport pair in the North America region, followed by Opa-Locka/Teterboro.

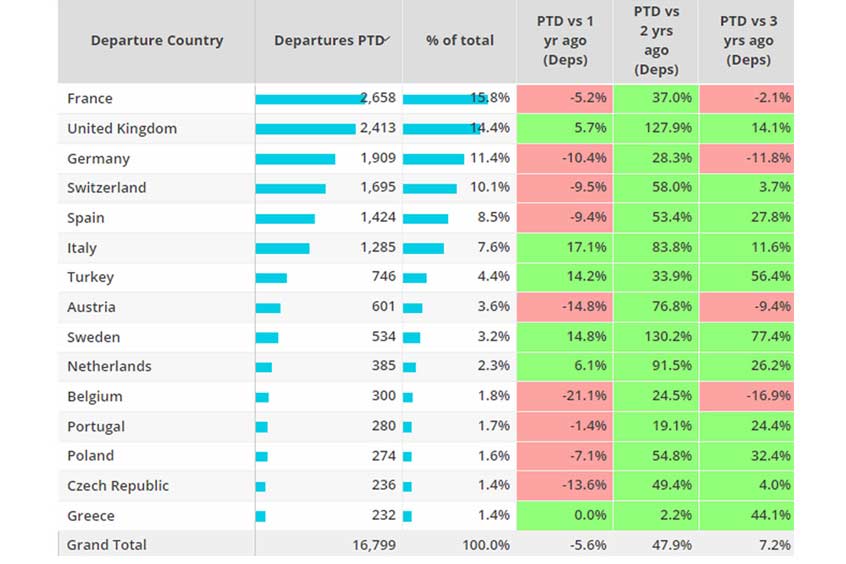

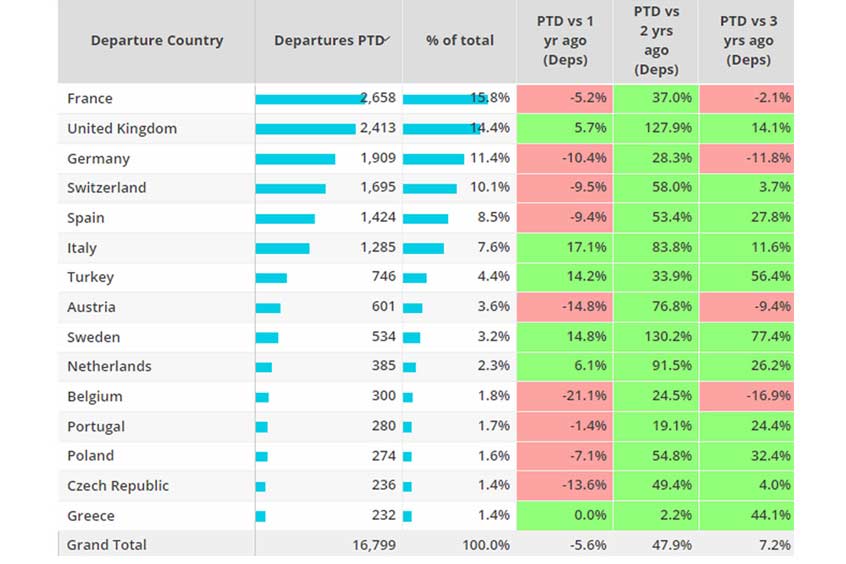

16 days into January and business jet flights in Europe are down 11 per cent compared to the same period last year, which is still seven per cent busier than pre-pandemic January 2019. Demand across the major business jet markets is mixed so far this month. France, the busiest market, is seeing a five per cent decline in sectors compared to last year. The UK has started January faster than it did 2022; its sectors are up six per cent, while Germany and Switzerland are seeing double digit declines. Excluding Russia from European business jet trends, departures are down six per cent compared to last year and seven per cent more than 2019.

International flights account for 71 per cent of business jet flights in Europe so far this month. International sectors are up seven per cent compared to 2019, although down 12 per cent compared to last year. Domestic business jet flights are up eight per cent compared to 2019, but seven per cent below last year. 64 per cent of business jet flights so far this month are less than 1.5 hours in duration, with sectors of this length up 11 per cent compared to 2019, although down two per cent compared to last year.

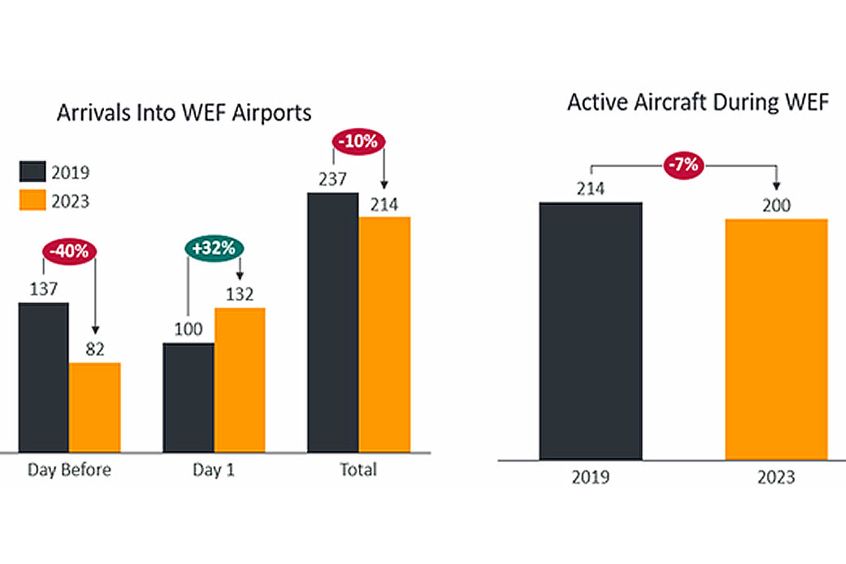

With Davos hosting the recent World Economic Forum, business jet arrivals into nearby airports (Samadan, Zurich, Dübendorf and St Gallen–Altenrhein airports in Switzerland) on the day before the 2023 event were down 40 per cent compared to the 2019 event, although up 32 per cent compared to the opening day in 2019. Overall business jet arrivals are down 10 per cent compared to the same two day period during the 2019 event. 200 different business jet aircraft were identified as active during the day prior to and first day of this year's event, seven per cent fewer than the same two days of the event in 2019. The top airport pair in the two day event period this year is Luton/St Gallen Altenrhein, followed by Luton/Zurich.

Outside of North America and Europe, business jet activity is 35 per cent above the same 16 day period in January last year and 83 per cent above pre-pandemic 2019. Half of all flights in the rest of world region are less than 1.5 hours in duration. Ultra-long-range flights are still behind pre-pandemic 2019 by 14 per cent, although they are experiencing triple digit growth compared to last year. Brazil is the busiest rest of the world (ROW) market so far this month, with its sectors up 23 per cent compared to last year. India and Argentina are seeing triple digit growth compared to last year, while departures from the United Arab Emirates are on par with last year. China is seeing a rebound in activity, with business jet sectors up 31 per cent compared to January last year. Beijing is driving the activity, with departures up 51 per cent compared to last year, while Sanya is up 63 per cent and Shanghai up 12 per cent.

WingX managing director Richard Koe comments: “Business jet activity is holding up, although losing some ground to last year's record January activity when the end of lockdowns released a surge of pent up demand. Transatlantic flight activity is still growing. The US charter market has come off last year's highs but is still much bigger than pre-pandemic. Regions like the Middle East are still seeing record business jet flight activity.”