Why visit ACE ’25?

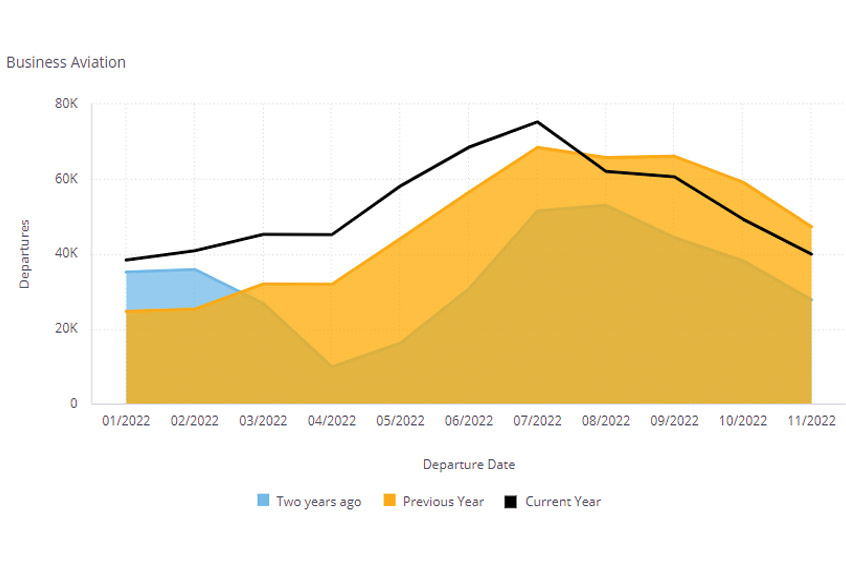

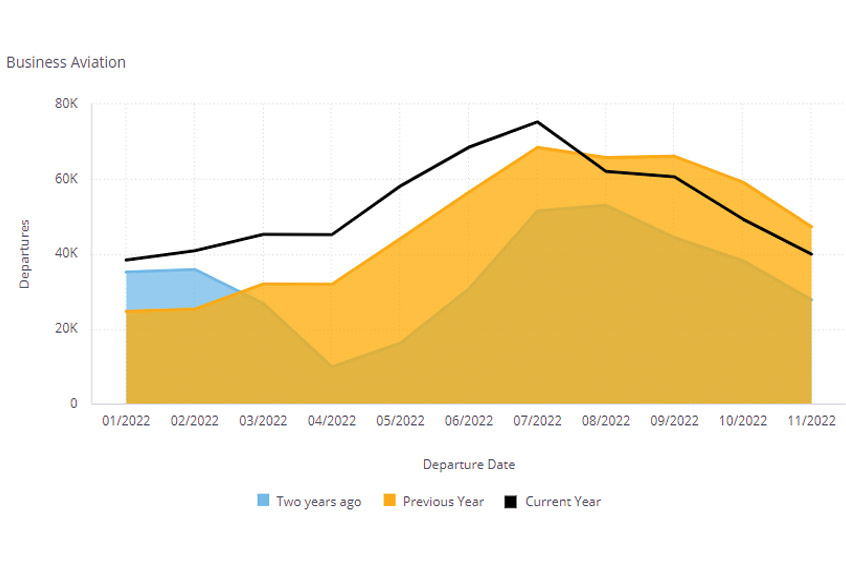

Worldwide fixed wing business aviation activity completed November 2022 with two per cent fewer flights than in November last year, but 13 per cent ahead of November three years ago. Year to date, from 1 January through 4 December, global business jet and prop activity is 11 per cent ahead of last year and 14 per cent above three years ago.

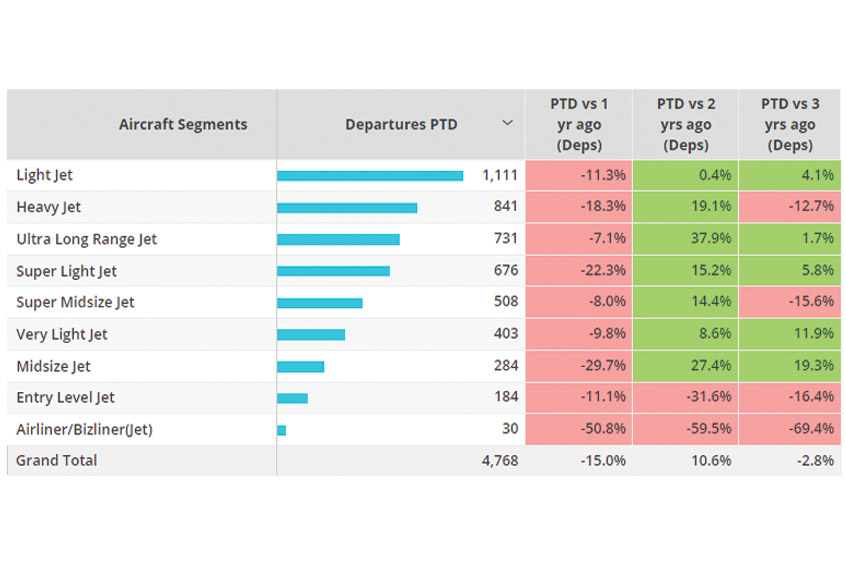

According to WingX's weekly Global Market Tracker business jets in North America flew three per cent fewer sectors in November compared to last year. November ranked the eighth busiest month this year, which is seasonally normal for pre-covid. The decline in year-on-year monthly traffic was the third successive. Teterboro topped the business jet departure list in November, where activity was three per cent above November last year and one per cent above November three years ago. Apart from Teterboro, among the top 10 airports in the US, only Dallas Love Field was busier this November than last November. Midsize jets saw the largest year-on-year decrease in sectors flown, with activity down 12 per cent compared to November 2021 and just one per cent up on November three years ago.

In week 48, ending 4 December, activity grew eight per cent compared to week 47. Compared to week 48 in 2021, business jet departures were down 11 per cent. Between 1-4 December there were almost 29,000 business jet sectors flown in North America, which is seven per cent behind last year and six per cent behind December 2019. These relatively large declines may be due to year-to-year changes in the dates of the Thanksgiving holidays. The drop in branded charter trips does seem unusually large in the first few days of December with 24 per cent fewer sectors than same dates last year and 18 per cent fewer than same dates in 2019. In contrast, private flight department activity was up three per cent in the first days of December and five per cent up on December 2019.

Business jet demand in Europe is unambiguously sagging. For the full month of November, business jet flights fell 15 per cent compared to November last year but still holding up at seven per cent higher than three years ago. The European area has now seen four consecutive months of decline compared to the same months in 2021, with the gap between 2022 and 2019 closing and heading for convergence by early next year. Some countries are already seeing fewer flights than in the same period of 2019, notably Germany. Conversely, business jet activity in both Sweden and Turkey was up in November 2022 compared to November 2021.

At the airport level, the busiest location Paris Le Bourget is seeing the largest falls in activity, with the first few days of December 28 per cent less busy than December 2021 and 11 per cent less than in December 2019. Farnborough and Geneva are seeing fewer departures at the start of this month compared to 2019, even if they are two per cent and eight per cent above 2021 respectively. All business jet segments have started the month of December with fewer flights than last year. Midsize and very light jets still have double-digit gains on the same period in 2019.

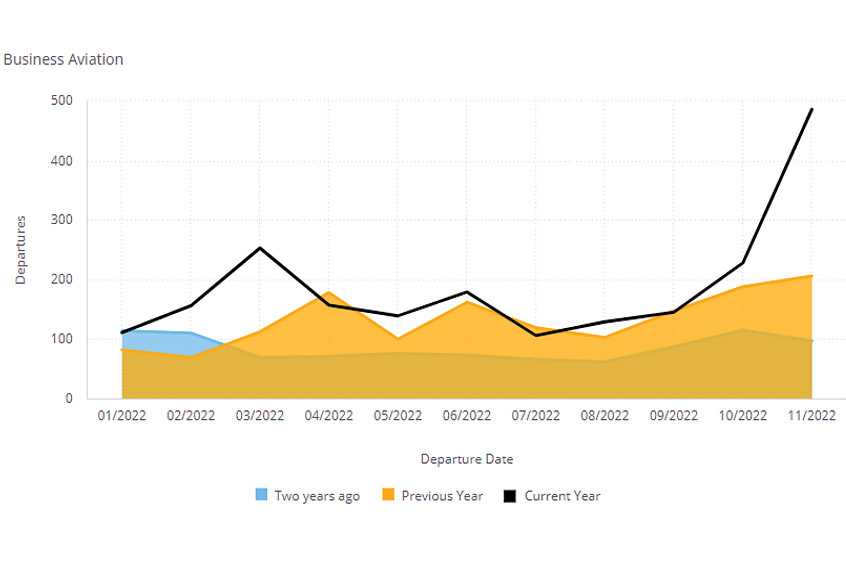

Activity outside of North America and Europe appears to be much stronger, with business jet flights up 22 per cent on November 2021 and 61 per cent above three years ago. In the last four weeks business jet activity in Africa is up 16 per cent compared to last year, while Asia is up 30 per cent and the Middle East up 18 per cent. In the Middle East business jet activity is continuing its record breaking run, boosted by visitors to the FIFA World Cup in Qatar. Arrivals into the host country are running 258 per cent above last December and almost 450 per cent above three years ago. November was by the far the busiest month for business jets, almost double the number of flights flown in March, the second busiest month. Key World Cup airports Hamad International, Doha International and Al Khor in Qatar have seen 279 per cent growth in average daily arrivals during the opening 15 days of the tournament.

WingX managing director Richard Koe says: “Business jet demand is clearly ailing in Europe with double digit declines compared to last year. The US dip may be distorted by Thanksgiving dates, but charter does look weaker. Business jet demand in the Middle East is relatively small, but still smashing records.”