Why visit ACE ’25?

In the first 29 days of August 2022, business jet and turboprop activity was still a fraction ahead of the same period in August last year, and 11 per cent higher than three years ago according to WingX's weekly Global Market Tracker. For the year to date, global business jet flights are up 20 per cent compared to same period last year and the same period for 2019. Global scheduled airline activity failed to hit the predicted summer recovery, with August showing 26 per cent fewer sectors than for August 2019. Focusing on the busiest global airlines (Southwest Airlines, American Airlines, Delta Air Lines, Ryanair and United Express), flights from 1 January through to 29 August are up 36 per cent compared to last year, but seven per cent below three years ago.

For the whole of August, business jet activity in North America is trending up one per cent compared to August last year and up 13 per cent compared to 2019. But in the most recent week, week 34 ending 28 August, business jet departures are down four per cent compared to the previous week. Overall activity was up by 0.5 per cent compared to the same week in 2021, but that was the offset of still-burgeoning private flight activity versus a slide in fractional and charter flights, trending down by eight per cent over the last four weeks. The Part 135 and 91K market in Florida, the erstwhile hub of pandemic-period activity, was down one per cent, which is an improvement on -3 per cent four-week trend, but demand in California is ebbing quite fast, with week 34 down by 11 per cent compared to a seven per cent fall in the last four weeks.

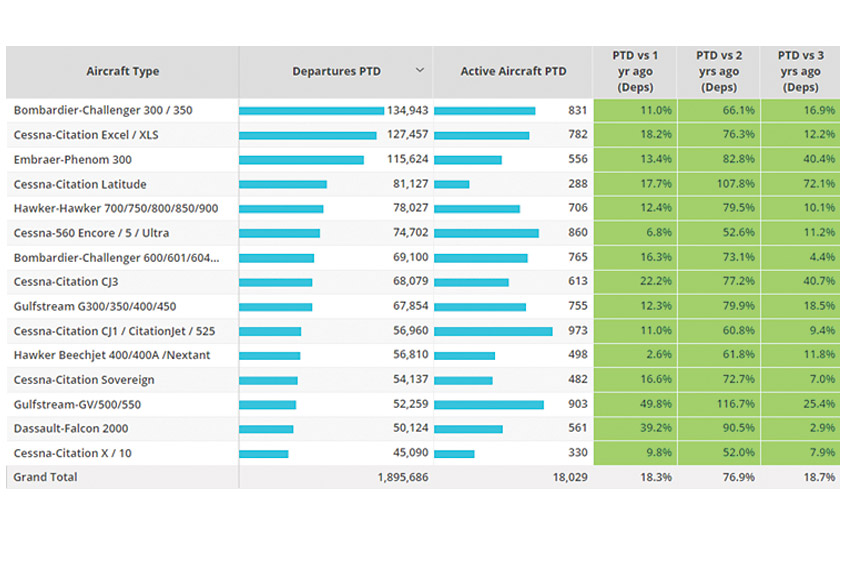

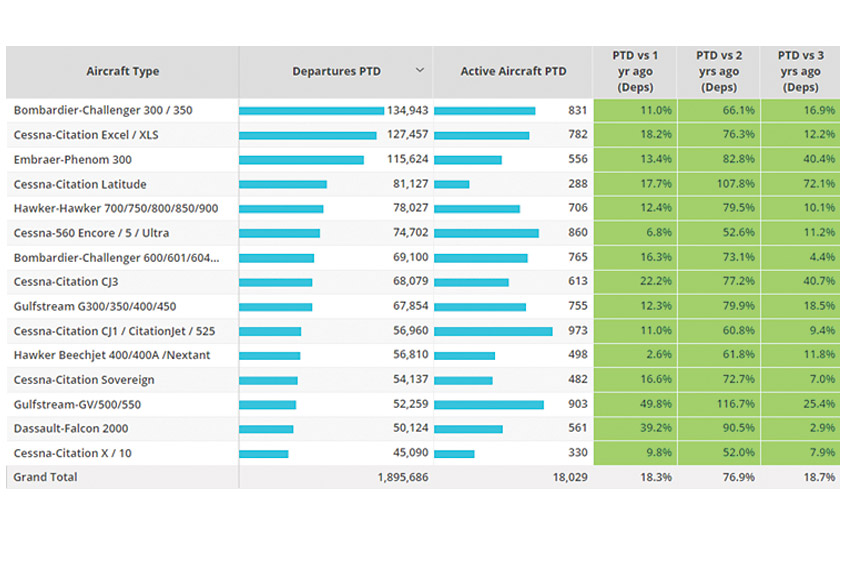

For the year so far, the overall region of North America has notched up record flight activity, with almost two million business jet sectors flown, up 18 per cent on last year, which by August 2021 had caught up with 2019. The US has a 23 per cent gain on the comparable year to date 2019, with both Canada and Mexico still trailing pre-pandemic activity. Destinations like Puerto Rico, Costa Rica and US Virgin Islands have at least 30 per cent gains on the pre-pandemic January-August 2019 period. Most of the Caribbean has seen record flight activity, with exceptions in Cayman, Bermuda and Barbados. Across the whole region, the Challenger 300/350 is the busiest jet this year, 17 per cent busier than pre-Covid. The Phenom and Latitude have seen the largest increases in fleet activity. The long-standing GV/500/550 fleet is flying 25 per cent more than in 2019.

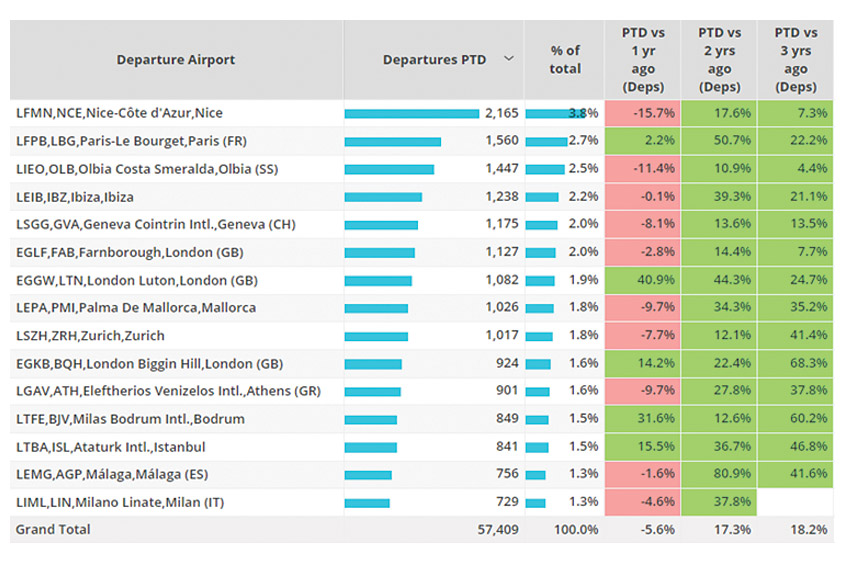

Across Europe, business jet departures so far this month are six per cent below August last year and 18 per cent ahead of August three years ago. In week 34, ending on 28th August, flight activity was seven per cent below the same week in 2019, with the AOC market, covering charter operations, slumping 10 per cent year on year, which is slightly worse than the eight per cent downward trend in the last four weeks. Most of the leading business aviation airports in Europe are seeing a slowdown versus the exceptional August activity last year, with Nice, Olbia and Majorca significantly less busy. There were exceptions, notably London Luton with a 40 per cent YOY increase, which takes it up 24 per cent on the comparable 2019 period, and London Biggin Hill, whose activity is up another 14 per cent on August last year, stretching the gains versus 2019 to 68 per cent this month.

Outside North America and Europe, YOY growth in business jet activity is 21 per cent, with a 52 per cent increase on August 2019. In the most recent week 34, key markets in Middle East, South America and Asia have had growth of around 15 per cent YOY, with demand in Africa ebbing to two per cent versus 2021. Business aviation in China continues to flatten due to prolonged covid measures, with January-August 2022 records now down by 47 per cent compared to last year and 37 per cent off the comparable 2019 period. The year to date growth in business jet flights is still impressive in Australia, Brazil, India and Nigeria, where departures from Abuja are down 18 per cent versus 2021 but still up by three times versus 2019.

WingX managing director Richard Koe comments: “Business aviation activity is on the slide as the month ends, most evidently in Europe, although this also reflects an unseasonably strong August 2021. For the year to date, business jet activity is holding at around 20 per cent above last year, at the point when the market had recovered back to 2019 levels. The big question is whether flight demand can weather the start of autumn and the swiftly deteriorating economic outlook in the next few months.”