Why visit ACE ’25?

The global pre-owned business aircraft market is beginning to show signs of stabilising after a heated two years. The second quarter 2022 market report from the International Aircraft Dealers Association (IADA) shows that 598 aircraft sales transactions were recorded by the group during the first half compared to 529 during the same period the prior year, a 13 per cent increase.

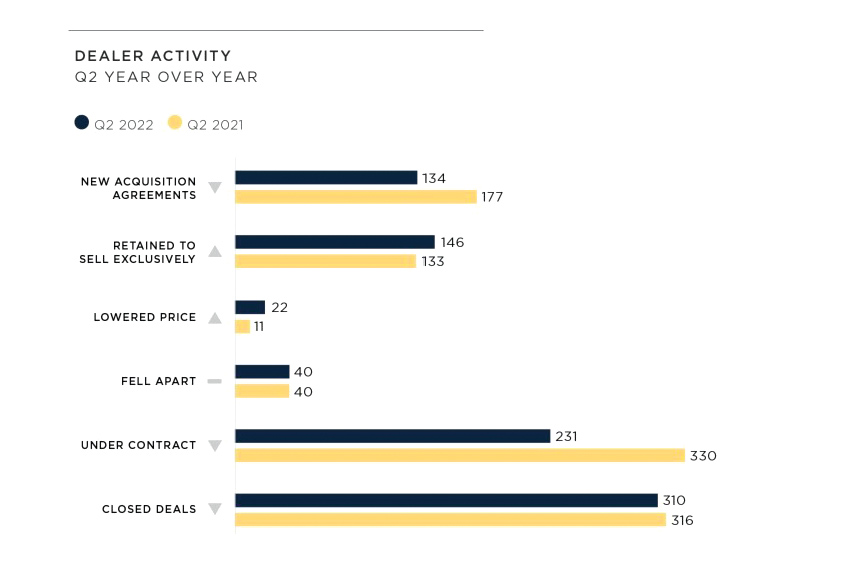

The increase was spurred by a robust first quarter in 2022, with the second quarter showing only a small decline of six aircraft transactions to a total of 310, compared to the same period in 2021 when 316 deals were recorded. Overall, the 2022 year-to-date sales numbers still reflect a healthy market, even higher than the record setting tempo in 2021.

“While we expect to see a strong market for the balance of this year, our dealers and transaction specialists are experiencing a bit of softening in some of the leading indicators for our industry,” says IADA executive director Wayne Starling. “While closed deals in the second quarter of 2022 remained healthy, a decrease in acquisition agreements and deals under contract indicate the market is returning to normal levels from the frenzied pace of 2021.”

IADA began the monthly tracking of sales metrics for pre-owned business aircraft in April 2020 due to the volatile market conditions caused by the pandemic. Transaction volumes by member dealers reflect the overall health of the used aircraft market because its dealers buy and sell more aircraft by dollar volume than the rest of the world's dealers combined.

Two key factors inform the report: First is the actual sales data supplied by IADA members who submit monthly transaction and activity reports to IADA. Second is the IADA members' market perspective, taken from a survey of the entire IADA membership.

Chad Anderson of Jetcraft says: “Commercial air service has not improved, if anything it has further degraded, the ultra high net worth population continues to increase and fractional/charter company demand continues to stay high. The extra quality supply that comes to market in 2022 will get absorbed, creating price stability. But we do not expect continued price increases realised previously in 2021.”

Paul Kirby of QS Partners says: “The historically strong charter market continues to fuel light and mid-cabin segments as there are simply not enough airplanes in the fleet to satisfy demand. Until such time as charter demand wanes, those markets are likely to remain strong as operators continue buying aircraft for core fleet. Limited inventory continues to constrain transaction volumes in all market segments. Pricing has stabilised in most markets with all but a handful of markets having peaked in value late in Q1. The macro-economic uncertainty, combined with rapidly rising inflation and stock market volatility, has created a sense amongst buyers of a looming market correction. This sense is also starting to impact interest levels as buyers believe waiting will result in more favourable pricing.”

Kyle Wagman of Leading Edge Aviation Services says: “We have hit a part of the market cycle where things have levelled off, a plateau of sorts. With interest rates rising and buyers that are weary of getting their toes wet in this market, I sense a cool down till the fourth quarter.”

Mike Francis of SVB Private Bank says: “Outlook seems a bit messy at the moment, with as many positive signs as there are negatives. A looming recession, inflation, supply chain issues and fuel prices are all drags, and there are more. Demand, I expect, will continue, and even if it falls off a bit, I'd in some ways prefer that as it'll help the market get back to its normal equilibrium. I'm seeing a lot of potential buyers get turned off to the prospect of buying a jet due to the premium they need to pay and/or the lack of inventory.”